How to Increase Your Medical Practice Profitability by Adding $100,000 a Year

Are you looking to increase your medical practice’s profitability? According to the Medscape Physician Compensation Report 2021, self-employed physicians earn an average of $352k per year.

This blog will provide tips and strategies on how you can add an extra $100,000 annually to your revenue! Intrigued? Let’s dive in!

Key Takeaways

- Self – employed physicians tend to earn more money, around $352k per year on average compared to employed physicians who make around $300k per year.

- Minimizing overhead costs by effectively managing corporate governance and carefully examining financial statements can help increase profitability.

- Implementing efficient billing practices, such as verifying insurance coverage before appointments and accurately coding procedures, can improve cash flow and collect payments more promptly.

Understanding the Concept of a Private Medical Practice

A private medical practice is a business run by doctors. They own the clinic and make all the choices. They see patients, handle their needs, and bill for their services. These clinics come in many sizes; a single doctor may run one, or many doctors can work together in a group practice.

In smaller offices, each doctor might also do tasks that larger places have staff for. Some of these jobs might be billing insurance firms or ordering supplies. Running your own place means more control but also much more work to do than just seeing patients! But for most doctors who run their own practices, the benefits are worth it.

Self-employed physicians tend to earn more money – about $352k per year on average compared to employed physicians who make around $300k per year.

https://www.youtube.com/watch?v=fO49-Tl7V-M

Essential Considerations Before Establishing a Practice

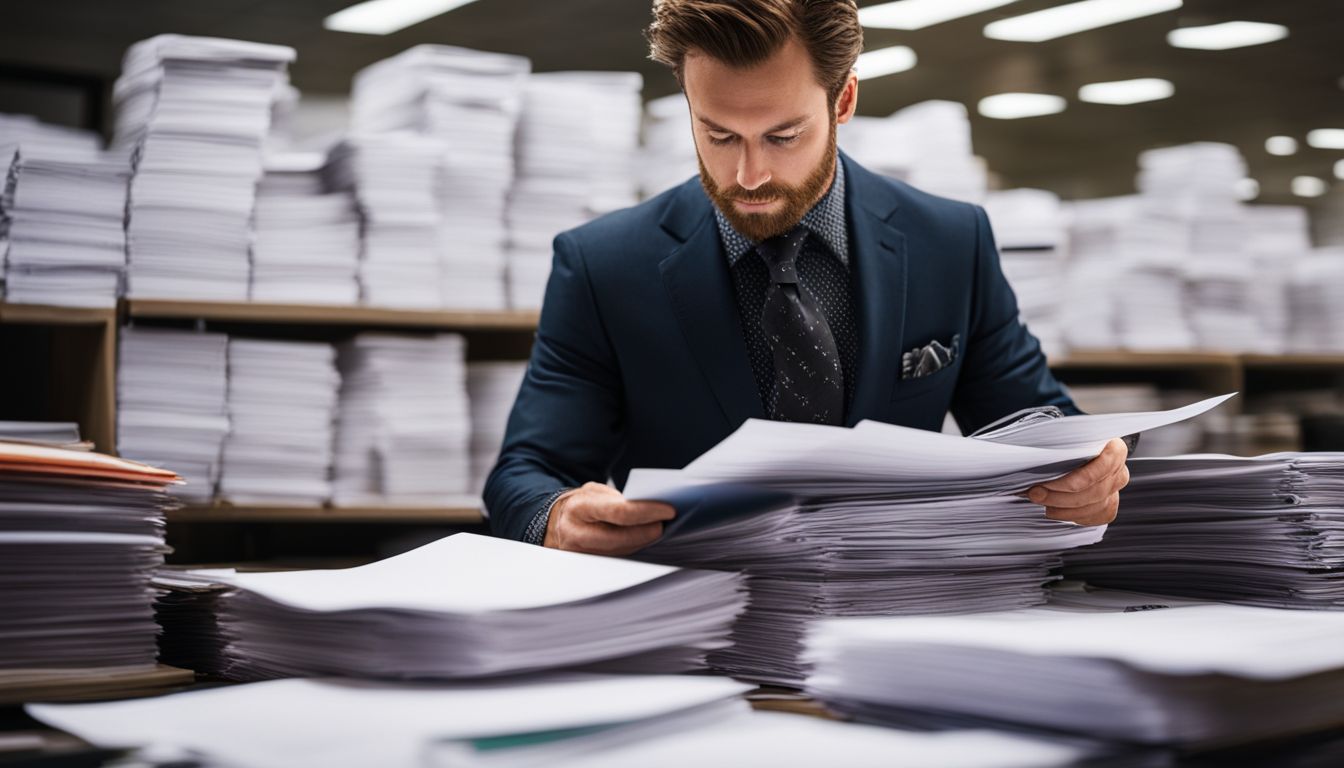

Before establishing a medical practice, it is crucial to review important documents, establish corporate governance practices, and carefully analyze financial statements and cost components.

Document Review

Checking papers is a key step. It helps figure out the worth of a medical practice. These papers can be rules, pact among owners, or job deals. They give important details about the business.

Checking papers is a key step. It helps figure out the worth of a medical practice. These papers can be rules, pact among owners, or job deals. They give important details about the business.

For example, they show how much money it makes and who owns what part of it. They also tell you about any debts or payments that are due. By looking at these papers, you can make sure everything is fair and right in your business plan.

Corporate Governance

Corporate governance is vital for a medical practice. It covers areas like practice management, hiring, billing and coding, and patient care. Checking existing bylaws, employment agreements, and shareholders’ arrangements forms part of this process too.

It also aids in deciding the worth of a medical practice by using financial statements and cost details. As an owner, you get more decision-making power than an employee would have which highlights the need for strong corporate governance.

Financial Statements and Cost Components

Money talks are part of owning a medical practice. Financial statements show how well the business is doing. They tell about profits and losses. Cost components are parts that make up the total cost of running a practice.

These include things like the value of buildings (real estate), money to be received from patients (accounts receivable) and equipment (hard assets). Some costs may not be easy to see such as goodwill, but they add value to your business too!

How to Determine the Valuation of a Practice

Learn the different methods for determining the value of a medical practice, including the P/E ratio, discounted cash flow method, and comparable sales method. Find out how these valuation techniques can help you make informed decisions about your practice’s worth.

Valuation With the P/E Ratio

The P/E ratio, or price-to-earnings ratio, is a way to determine the value of a private medical practice. It is calculated by dividing the market price per share by the earnings per share.

A higher P/E ratio suggests that investors are willing to pay more for each dollar of earnings generated by the practice. By adding $100,000 a year to the practice’s profits, you can increase its earnings and potentially raise its P/E ratio.

This can result in a higher valuation for your practice, making it more attractive to potential buyers or investors.

The Discounted Cash Flow Method

The Discounted Cash Flow Method is a way to determine the value of a medical practice. It considers factors like financial statements, cost components, and cash flow to estimate the practice’s worth.

This method involves projecting future cash flows and then discounting them back to their present value. By doing this, it accounts for the time value of money and helps evaluate how valuable those future cash flows are in today’s terms.

Other methods such as the P/E ratio and comparable sales method can also be used in valuation, but the Discounted Cash Flow Method is commonly used because it takes into account the specific financials of the practice.

The Comparable Sales Method

The Comparable Sales Method is a way to figure out how much a medical practice is worth. With this method, you look at the sales prices of similar practices in the same area. By comparing these sales, you can determine the fair market value of your own practice.

It’s important to keep good financial records and documentation when using this method. If you want accurate results, it’s best to get help from experts or consultants who specialize in valuing practices.

Understanding Payment Structures and Compensation Models

In this section, we will discuss the different payment structures and compensation models that can be implemented in a medical practice, including the equal allocation model, production allocation model, and two-tiered allocation model.

The Equal Allocation Model

The Equal Allocation Model is a fair and equal way to distribute payments and compensations among medical practitioners. It is especially beneficial for doctors who have chosen to start their own private practices.

With this model, all providers receive an equal share of the payments based on their contribution, regardless of factors like seniority or productivity. This helps promote collaboration and teamwork among the practitioners, as everyone feels valued and rewarded equally.

By implementing the Equal Allocation Model, medical practices can ensure a fair distribution of payments while fostering a positive working environment.

The Production Allocation Model

The Production Allocation Model is a compensation model used in medical practices to distribute payments based on the productivity of each physician or healthcare provider. Under this model, physicians are rewarded for the quantity and complexity of the services they provide.

The more procedures performed or patients seen, the higher their compensation. This model incentivizes healthcare providers to be more efficient and productive, which can lead to increased revenue for the practice.

By closely tracking and measuring individual performance, practices can ensure fair distribution of payments while encouraging high-quality patient care.

The Two-Tiered Allocation Model

The Two-Tiered Allocation Model is a payment structure that focuses on maximizing revenue for medical practices. It emphasizes the importance of efficient billing and coding practices to ensure proper reimbursement rates.

By accurately coding medical procedures and services, healthcare providers can increase their chances of receiving higher payments from insurance companies. Strategies such as reducing denied claims and improving revenue cycle management are recommended to optimize revenue generation.

Additionally, negotiating contracts with insurance companies helps secure fair reimbursement rates. Implementing a tiered fee structure that rewards providers for delivering high-quality and efficient care is also suggested under this model.

Strategies to Add $100,000 a Year to Your Medical Practice

Implementing cost-saving measures, investing in growth opportunities, and optimizing billing practices are key strategies to add $100,000 a year to your medical practice.

Minimizing Overhead Costs

Minimizing overhead costs is an important strategy in increasing the profitability of a medical practice. By reducing expenses, practices can free up resources and increase their bottom line.

One way to minimize overhead costs is by effectively managing corporate governance, which includes areas like practice management and patient care. Ensuring efficient workflows, optimizing staffing levels, and streamlining administrative processes can all contribute to cost savings.

Another factor in minimizing overhead costs is carefully examining financial statements and identifying cost components that can be reduced or eliminated. This may include evaluating expenses related to hard assets, real estate, and cash flow.

Investing in Growth

Investing in growth strategies is vital for increasing the profitability of a medical practice. By allocating resources towards expanding the practice, such as implementing new services or facilities, a medical practice can attract more patients and generate additional revenue.

This can be done through marketing initiatives to reach a wider audience, enhancing patient experience and satisfaction, and staying up to date with advancements in technology and healthcare practices.

Investing in growth not only increases profit but also helps the practice stay competitive in the market and provide better quality care to patients.

Efficient Billing Practices

Implementing efficient billing practices is crucial for increasing revenue in a medical practice. By streamlining the billing process and minimizing errors, medical practices can improve their cash flow and collect payments more promptly.

This includes verifying patients’ insurance coverage before appointments, accurately coding procedures, submitting claims on time, and following up on unpaid balances. Efficient billing practices also involve utilizing electronic health record (EHR) systems or outsourcing to medical billing services to automate tasks and ensure accurate documentation.

By adopting these strategies, medical practices can add $100,000 a year to their profitability.

The Role of a Practice Manager in Enhancing Revenue

The practice manager plays a crucial role in enhancing revenue and increasing profitability for a medical practice. They oversee the day-to-day operations of the practice, ensuring its success.

One way they contribute to revenue enhancement is by setting up electronic health record (EHR) systems and practice management systems. These systems streamline processes, improve efficiency, and help maximize billing accuracy, leading to increased revenue.

Additionally, the practice manager is responsible for hiring a reliable office manager who can efficiently handle administrative tasks and ensure smooth operations. By implementing effective billing practices and minimizing overhead costs under their guidance, the practice can optimize revenue generation.

Moreover, the practice manager may explore opportunities to offer ancillary services based on specialty and patient needs in order to generate additional income while differentiating the practice from competitors.

The Impact of Marketing and Branding on Practice Revenue

Marketing and branding play a crucial role in boosting practice revenue for medical professionals. Effective marketing strategies can increase profitability by adding $100,000 per year to a medical practice.

By implementing targeted marketing campaigns, healthcare providers can attract new patients and retain existing ones, resulting in higher revenue. Developing a strong brand identity and reputation is also essential as it helps differentiate a medical practice from its competitors and attracts more patients.

Online marketing techniques such as search engine optimization (SEO) and social media advertising can have a significant impact on practice revenue as they effectively reach and engage potential patients.

Overall, investing in marketing efforts and creating a recognizable brand can significantly contribute to the financial success of a medical practice.

Partnering with Experts for Financial Management and Contract Review

Partnering with experts in financial management and contract review is crucial for increasing the profitability of a medical practice. These experts can provide valuable guidance and help save money for the practice.

Here are some areas where partnering with experts can be beneficial:.

– Accounting: Working with an experienced accountant ensures accurate tracking of expenses, revenue, and tax obligations.

– Legal Assistance: A healthcare attorney can review contracts, negotiate favorable terms, and ensure compliance with legal requirements.

– Coaching: Hiring a coach who specializes in medical practices can provide guidance on financial planning, business growth strategies, and improving overall performance.

– Insurance Advisors: Working with insurance advisors helps identify the right coverage options for malpractice insurance and other types of coverage needed by the practice.

– Financial Planning: Engaging a financial planner helps create long-term financial goals, manage investments effectively, and plan for retirement.

By partnering with these experts, medical practices can make informed decisions that lead to increased profitability while minimizing risks associated with finances and contracts.

Evaluating Practice Performance Regularly

Regularly evaluating practice performance is important for increasing profitability:

– Set specific goals and benchmarks.

– Analyze key performance indicators (revenue, patient satisfaction, productivity).

– Implement strategies to increase patient volume (marketing campaigns, referral programs).

– Optimize billing and coding processes.

Conclusion

In conclusion, increasing the profitability of your medical practice by adding $100,000 a year is achievable with the right strategies. By minimizing overhead costs, investing in growth opportunities, and implementing efficient billing practices, you can boost your revenue.

Additionally, partnering with experts for financial management and regularly evaluating practice performance will help ensure long-term success. With these steps in place, you can take your medical practice to new heights of profitability.

FAQs

1. How can owning a medical practice increase my profit?

Owning a medical practice, through methods like buying into a practice or phased-in buy-in, lets you have an ownership interest. This means more income from patient billings and billing collections.

2. What is vital to know before I join as a partner in group practices?

Knowing things like the book value of the business, startup costs, and shareholders’ agreements are important. You should also understand your employment contract and your role as a physician-partner.

3. How can I attract more patients to my primary care practice?

Using good marketing tools helps grow your patient panel. These include Aetna credentialing for insured patients, online booking via ZocDoc, advertising on LinkedIn, Google or Facebook and good old “word of mouth”.

4. As a co-owner and surgeon in my own clinic, how can I cut down costs?

Invest in quality control while being frugal about lifestyle choices: efficient use of medical equipment; telemedicine options instead of always face-to-face meetings; careful planning with payroll providers; reinvesting profits back into the clinic when necessary.

5. Where do I begin if I want to start up my own medical business?

The Startup Basics for starting your own medical business include obtaining funding from professional associations or bank loans to cover startup cost including purchasing equipment like Electronic Medical Records (EMR) systems & hiring office managers.

6.How do regulations affect me when trying to increase revenue projections at my health center?

Rules set by IRS regarding S corp distribution/payroll tax could affect you financially along with Medicare/Medicaid policies if dealing with federally qualified healthcare centers which require compliance documentation & maintaining appropriate insurance covers.

Leave a Reply